BTC Price Prediction: 2025-2040 Forecasts and Key Influencing Factors

#BTC

- Institutional Accumulation: Major investments from pension funds and corporations signal strong confidence in BTC's future.

- Technical Indicators: MACD and Bollinger Bands suggest a potential bullish reversal despite current consolidation.

- Mining Innovations: Hybrid PoW-PoS solutions and cloud mining platforms enhance network security and accessibility.

BTC Price Prediction

BTC Technical Analysis: Current Trends and Future Projections

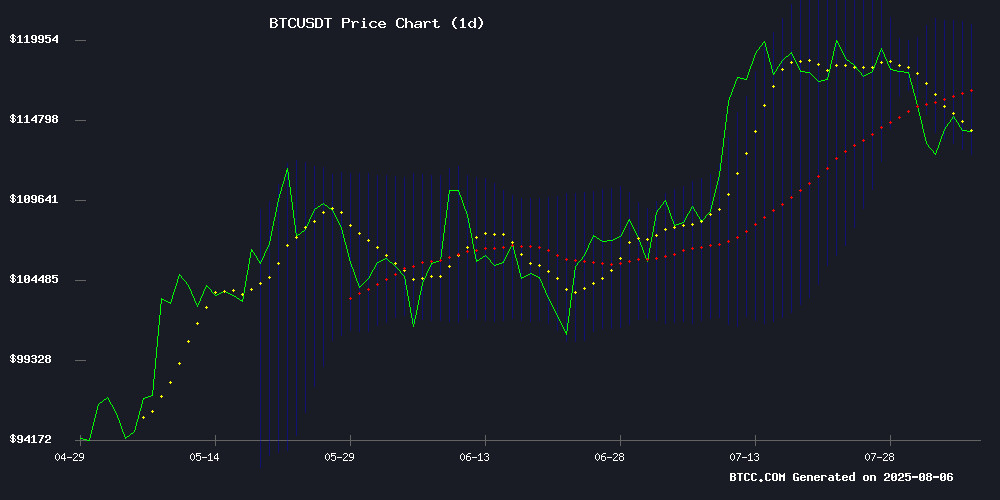

According to BTCC financial analyst James, BTC is currently trading at 114021.57 USDT, slightly below its 20-day moving average (MA) of 116764.42. The MACD indicator shows a bullish crossover with the MACD line at 2162.89 above the signal line at 470.05, suggesting potential upward momentum. Bollinger Bands indicate a tightening range with the price NEAR the middle band, signaling consolidation before a potential breakout.

James notes that while the price is below the 20-day MA, the MACD's positive divergence and the narrowing Bollinger Bands could indicate an upcoming bullish phase if BTC holds above the lower band at 112573.37.

Market Sentiment: Institutional Interest and Long-Term Optimism Drive BTC

BTCC financial analyst James highlights growing institutional interest, as evidenced by Michigan Pension Fund tripling its Bitcoin ETF investment to $10.7M and Metaplanet's $53M BTC purchase. News of hybrid mining solutions and enhanced market monitoring tools further bolster confidence in BTC's long-term viability.

James points out that while short-term price predictions vary, the overarching sentiment remains bullish due to institutional accumulation and advancements in mining technology. The market rebound hinted by Binance metrics aligns with the technical analysis, suggesting reduced sell pressure.

Factors Influencing BTC’s Price

Bitcoin Price Prediction: Diverging Views on August Trajectory

Bitcoin's price action at $114,000 has traders divided between two stark possibilities: a bullish breakout to $125,000 or a retracement to $100,000. Institutional inflows continue unabated, suggesting underlying confidence in the asset despite recent volatility.

The market shows signs of consolidation, with BTC down 1% daily and 4% weekly. Open interest in perpetual futures contracts declines, yet analysts like Crypto Rand observe persistent dip-buying—a classic hallmark of bull market behavior.

Layer-2 solutions like Bitcoin Hyper (HYPER) gain attention as potential beneficiaries of Bitcoin's next major move. The project's emergence coincides with growing institutional participation, reinforcing Bitcoin's centrality in the digital asset ecosystem.

Michigan Pension Fund Triples Bitcoin ETF Investment to $10.7M

Michigan's state pension fund has significantly increased its exposure to Bitcoin through a $10.7 million investment in the ARK 21Shares Bitcoin ETF (ARKB). SEC filings reveal the fund tripled its position to 300,000 shares between March and June 2025, up from 100,000 shares previously. The move reflects growing institutional confidence in regulated crypto products following the SEC's January 2024 approval of spot Bitcoin ETFs.

ARKB, which tracks Bitcoin's price without direct BTC ownership, saw its value in Michigan's portfolio surge from $4.1 million to $10.7 million. The ETF trades at $37.78, boasting a 20% year-to-date gain and 110% annual return. This follows similar institutional moves, including Wisconsin's investments in BlackRock and Grayscale Bitcoin ETFs, signaling broader acceptance of crypto through regulated vehicles.

The SEC's recent expansion of Bitcoin ETF options contracts further underscores the maturing institutional framework for digital asset exposure. Pension funds and public institutions are increasingly viewing Bitcoin ETFs as a legitimate component of diversified portfolios.

Bitcoin Surges as Market Dynamics Shift Amid Institutional Accumulation

Bitcoin trades at $113,800 despite a 24-hour dip to $112,650, demonstrating resilience against broader altcoin weakness. Global risk aversion—fueled by geopolitical tensions and political volatility—has tempered speculative appetite, yet BTC maintains dominance.

On-chain analyst Ki Young Ju retracted earlier bearish predictions, citing structural shifts from ETF inflows and corporate treasury strategies. "Whales realized profits, but Michael Saylor’s absence of a sell button canceled bear markets," he noted. Institutional accumulation patterns now defy traditional metrics, with firms like MicroStrategy leveraging appreciating reserves to compound gains.

Bitcoin Price Prediction: Ascending Channel Breakdown in Sight?

Bitcoin's price oscillates between $113k and $116k, teetering on the edge of a decisive breakout or breakdown. Traders brace for volatility as the cryptocurrency consolidates after a period of relative stability.

ETF momentum wanes, with three consecutive days of outflows totaling $333 million in August. Institutional holdings shrink from $155 billion to $148 billion, signaling profit-taking or strategic repositioning.

Technical patterns emerge as BTC finds strong support near $96k, rebounding to set a July high above $123k. The failure to sustain this peak leaves the market questioning whether this represents temporary resistance or a longer-term ceiling.

Experts Advocate Holding Bitcoin as a Long-Term Family Asset

Altcoin Daily, a prominent cryptocurrency YouTube channel, has proposed a novel strategy for Bitcoin holders: allocate 0.01 BTC for each family member as a generational investment. At current prices near $114,400 per Bitcoin, this translates to roughly $1,144 per allocation—a modest sum with potentially outsized future returns given Bitcoin's fixed 21 million supply cap.

The recommendation taps into growing institutional narratives around Bitcoin's scarcity value, echoed by figures like MicroStrategy's Cole Walmsley and investor Robert Kiyosaki. Their bullish stance reflects broader market confidence, evidenced by MicroStrategy's continued accumulation of BTC reserves despite volatility.

This advice positions Bitcoin not as a speculative trade but as a strategic reserve asset—a digital heirloom whose value proposition strengthens with each halving cycle and adoption wave. The suggestion to denominated holdings in satoshis (0.01 BTC units) makes accumulation psychologically accessible to retail investors.

CryptoAppsy Enhances Real-Time Market Monitoring for Investors

CryptoAppsy emerges as a critical tool for cryptocurrency investors, offering real-time price tracking and portfolio management without the friction of account creation. The app's lightweight design belies its robust capabilities, delivering millisecond updates across thousands of assets from Bitcoin to emerging altcoins.

Market participants gain arbitrage advantages through globally-sourced exchange data, while customizable watchlists eliminate noise from disparate trading platforms. Portfolio valuation features automatically sync with live market rates, transforming manual holdings into dynamic dashboards.

Binance BTC Metrics Hint at Waning Sell Pressure and Potential Market Rebound

Recent on-chain and derivatives market signals suggest Bitcoin's sharp price declines may be entering a cooling-off phase, particularly on Binance—the largest crypto exchange by volume. Key divergences between price action and open interest data indicate fading bearish momentum.

Bitcoin recently dropped below $113,000, marking a lower low on the price chart. However, Binance’s 24-hour Open Interest percentage formed a higher low over the same period. This divergence—where price falls but open interest decline slows—is often seen as a bullish signal. According to CryptoQuant, such a pattern typically points to a phase of capitulation where traders are closing positions with decreasing urgency.

The gradual unwinding of positions through staggered liquidations often sets the stage for trend exhaustion. When sellers run out of steam, market conditions can shift, creating room for a reversal or at least a consolidation.

Another revealing metric is the spot vs. perpetual price spread, which currently reflects heightened risk aversion among traders. This cautious sentiment, combined with the open interest divergence, suggests the market may be nearing a turning point.

Metaplanet Doubles Down on Bitcoin with $53M Purchase, Targets 210,000 BTC by 2027

Japanese investment firm Metaplanet has intensified its Bitcoin accumulation strategy, purchasing an additional 463 BTC ($53 million) this week. The move brings its total holdings to 17,595 BTC worth approximately $2 billion at current prices, cementing its position as Asia's most aggressive corporate Bitcoin adopter.

The acquisition follows Michael Saylor's MicroStrategy playbook, with Metaplanet publicly committing to amass 210,000 BTC within three years. This institutional endorsement comes as Bitcoin ETFs bled $643 million last week, triggering what some traders dubbed the "Bitcoin August Curse" - though the cryptocurrency has since rebounded above $114,000.

Market observers note Metaplanet's actions demonstrate growing institutional conviction beyond Western markets. The Tokyo-listed firm's treasury strategy now accounts for nearly 0.1% of Bitcoin's total supply, with its latest purchase executed during a period of ETF outflows and retail skepticism.

Seven Bitcoin Cloud Mining Platforms to Watch in 2025, Including INE Miner

The globalized computing power landscape is set for a transformation by 2025, with INEminer leading the charge among seven notable Bitcoin cloud mining platforms. Leveraging distributed GPU computing clusters and intelligent scheduling algorithms, INEminer offers zero-barrier digital currency mining services. Its 'computing power as a service' model disrupts traditional mining's high costs and energy demands.

INEminer distinguishes itself with four core advantages: eliminating operational costs through an app-based process, flexible lease terms from 2 days to 36 months, blockchain-audited transparency, and geothermal-powered green mining certified in Iceland. The platform's carbon footprint reduction of 0.03 tons of CO2 equivalent per terahash aligns with growing environmental consciousness in crypto.

New users can access $100 in mining credits through a streamlined onboarding process at www.ineminer.com, signaling the platform's push for mainstream adoption. This development reflects broader industry trends toward accessible, sustainable mining solutions as Bitcoin's ecosystem matures.

INEMiner Introduces Hybrid PoW-PoS Cloud Mining Solution for BTC in 2025

INEMiner's 2025 cloud mining platform merges Proof-of-Work with Proof-of-Stake mechanics, allowing miners to boost earnings by 20% through IMT token staking. The system's smart contract architecture automates profit distribution, addressing longstanding withdrawal hurdles in conventional mining operations.

The platform distinguishes itself through blockchain-verified green energy usage via PowerLedger protocol, achieving 92% improvement in carbon transparency. Its jurisdictional smart contracts enable precise tax settlements with 99.7% accuracy, while DAO-governed node distribution meets SEC decentralization standards.

Prospective users can initiate mining through a streamlined three-step process: rapid registration, contract selection, and daily profit accumulation. The FCA-licensed operation leverages renewable energy sources while offering distributed computing power.

OurCryptoMiner Introduces BTC Cloud Mining Contracts Amid Growing Demand for Stable Returns

Bitcoin continues to solidify its position as the leading digital currency, attracting investors seeking wealth preservation and asset appreciation. Against a backdrop of macroeconomic uncertainty and persistent inflation, its safe-haven appeal has intensified.

OurCryptoMiner's newly launched BTC cloud mining contracts offer a streamlined alternative to traditional mining. The platform eliminates hardware procurement and high energy costs, providing daily settlements with advertised yields exceeding 50%. These contracts target investors looking to combine Bitcoin's growth potential with more predictable returns.

The service arrives as traditional investment vehicles struggle to deliver competitive returns. OurCryptoMiner promises to handle all technical complexities, allowing participants to benefit from mining operations without specialized knowledge or infrastructure.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical and fundamental analysis, BTCC analyst James provides the following long-term projections for BTC:

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | 100,000 - 150,000 | Institutional adoption, ETF inflows, halving effects |

| 2030 | 250,000 - 500,000 | Mainstream integration, regulatory clarity, scarcity |

| 2035 | 500,000 - 1,000,000 | Global reserve asset status, DeFi growth |

| 2040 | 1,000,000+ | Network maturity, store-of-value dominance |

James emphasizes that these estimates assume continued institutional participation and no black swan events. Short-term volatility may persist, but the long-term trajectory remains upward.